Account Opening Automation in Banking with a Low-Code Solution

Discover how a leading bank modernized its corporate account opening process using a low-code banking solution. By implementing account opening automation, the bank streamlined workflows, reduced errors, and improved visibility across teams. Learn how low-code platforms can transform complex banking operations efficiently.

What began as a single project with one of the largest banks in South-Central Europe soon expanded into a broader collaboration. After seeing clear improvements in their loan origination process, the bank entrusted us with modernizing its account opening process for corporate clients using a low-code banking solution. This initiative aimed to achieve account opening automation, streamline workflows, and improve visibility across teams.

The Challenge

The bank's existing account opening process was plagued by inefficiencies that are all too common in traditional banking:

- Fragmented workflows across multiple teams and departments

- Manual, paper-based approvals that created bottlenecks

- Disconnected systems with no single source of truth

- Limited visibility into the status of ongoing applications

- High risk of errors and delays due to miscommunication

For a large bank processing hundreds of corporate account applications, these issues led to delays, operational strain, and inconsistent customer experience. The bank needed a single, structured process that could replace manual handoffs and provide clear visibility for everyone involved.

The Result: A Unified Low-Code Solution

We worked with stakeholders to design a custom Account Opening solution using Microsoft Power Platform tools. Instead of just digitizing the old process, our solution centralizes information, streamlines approvals, and gives all teams clear visibility into each application.

Process Architecture

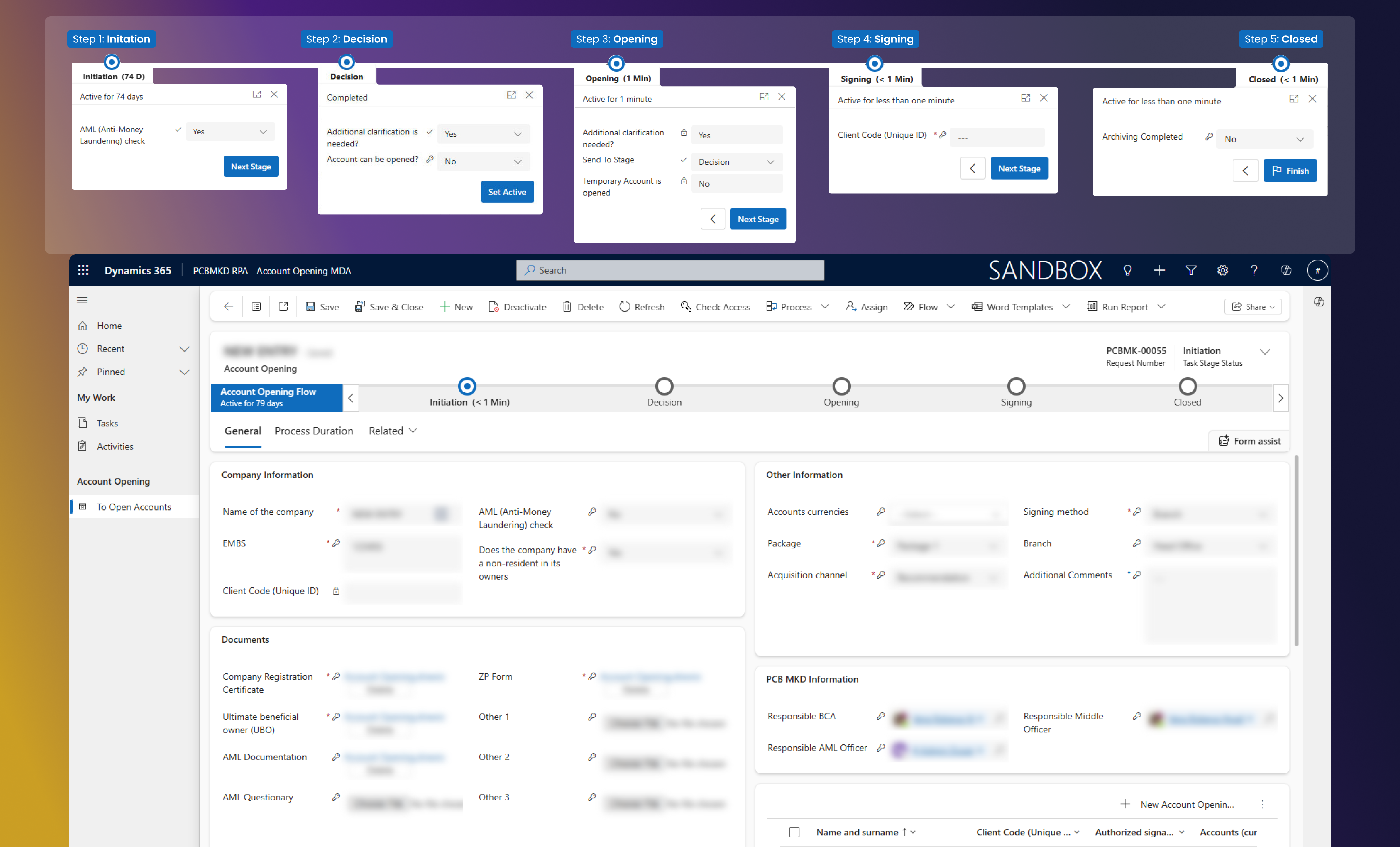

We structured the account opening journey into five distinct stages, each with clear ownership and responsibilities:

1. Initiation

The business client advisor gathers and uploads required documents.

2. Decision

The Anti-Money Laundering (AML) officer reviews documents and ensures compliance.

3. Opening

Middle Officers and Client Advisors verify requirements and approve account setup.

4. Signing

Upon approval, a Unique Client ID is assigned and documents are archived automatically.

5. Closed

The process completes and stakeholders are notified.

Role-Based Access Control

We defined four key roles, each with specific permissions and responsibilities:

- Business Client Advisor – Starts applications and manages clients

- Anti-Money Laundering Officer – Reviews for compliance

- Middle Officer – Coordinates approvals and account setup

- Client Advisor – Supports the client through the onboarding process

This role-based approach ensures that each team member sees exactly what they need, when they need it, without being overwhelmed by irrelevant information.

Technical Implementation

The platform was built using a modern low-code approach that balanced rapid development with enterprise-grade capabilities:

- Microsoft Power Apps forms the core of the solution

- Custom HTML and JavaScript components enhance the user experience where specialized functionality is needed

- Power Automate Cloud Flows handles notifications and approvals, automatically triggering emails when actions are required or status changes occur

- Third-party storage API integration ensures all finalized documents are securely archived in the bank's existing document management system

By leveraging Power Automate for the notification engine, we avoided the need for custom C# code, keeping the solution maintainable and within the bank's existing IT ecosystem. Every status change, document upload, or approval request automatically generates targeted notifications to the appropriate team members and branches, ensuring nothing falls through the cracks.

Platform Capabilities

Real-Time Collaboration

All teams work in a single platform, with updates and requests visible instantly across roles.

Intelligent Filtering and Search

Quick search by status (very important for the bank), client, officer, or date reduces time spent finding applications.

Automated Notifications

Stage changes, document uploads, and required actions trigger contextual alerts to keep the team synchronized.

Audit Trail and Transparency

Every action is logged for transparency and regulatory compliance.

Seamless Archiving

Documents are automatically packaged and sent to secure storage once a Unique Client ID is assigned. Everything is stored on a third-party solution, which is controlled by the bank.

Conclusion

By replacing manual, fragmented workflows with a centralized low-code banking solution, the bank achieved account opening automation, accelerated corporate account onboarding, reduced errors, and improved visibility across teams. This approach shows that even complex, regulated banking processes can be modernized efficiently, delivering measurable impact in a matter of months.

For organizations facing similar challenges with legacy account opening processes, don’t worry - we can help. With the right approach, strategic use of low-code platforms, and deep understanding of banking workflows, you can achieve remarkable results in months.

Book free consultation

Let's talk!