How Microsoft Business Central Could Have Prevented the Marvel Bonus Mix-Up

Accidents happen, especially in the fast-paced world of business, where countless transactions occur every day. However, with the right tools and systems in place, many of these mishaps can be easily avoided.

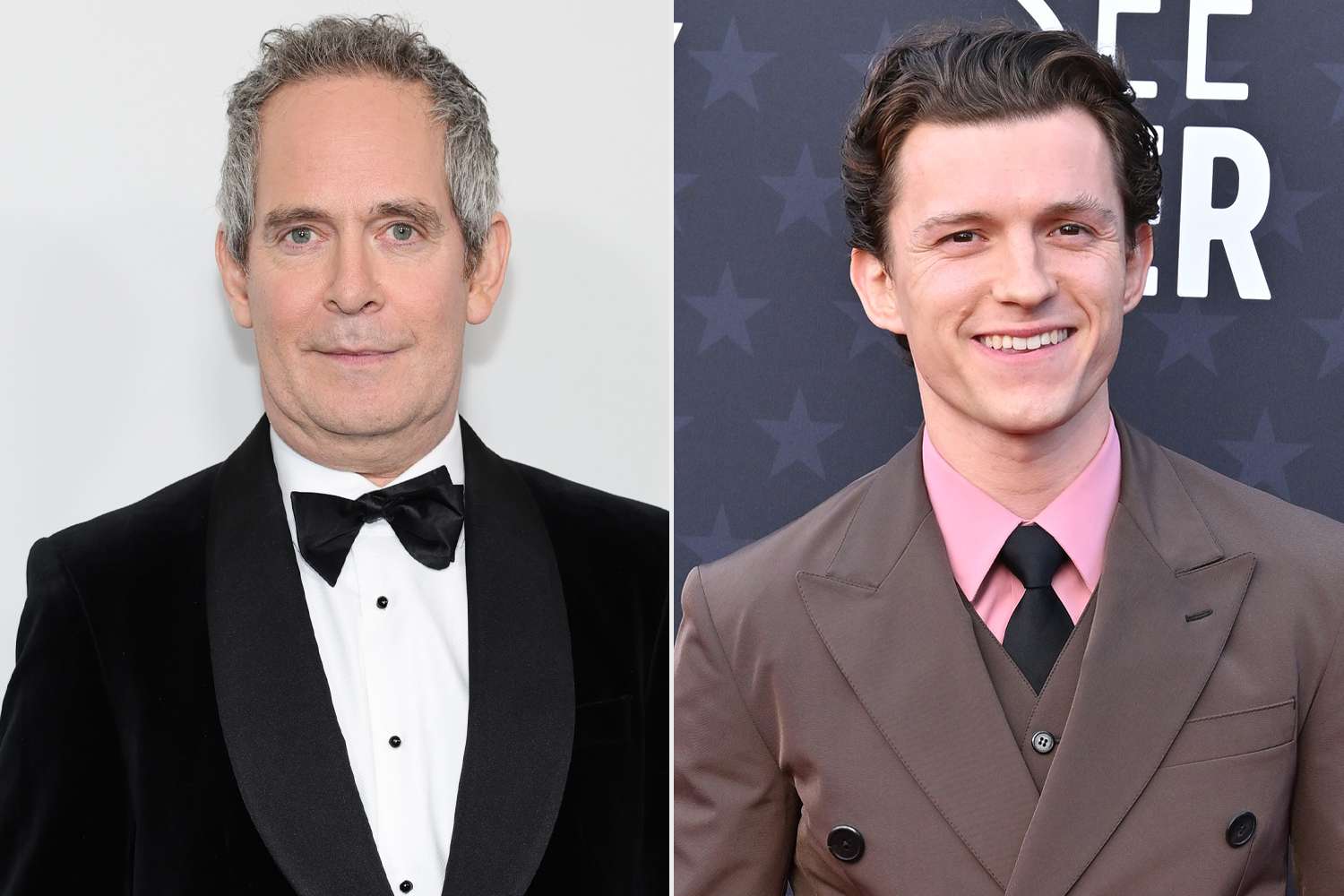

A recent media uproar involving British actor Tom Hollander and Marvel superstar Tom Holland highlights the importance of robust financial management systems in preventing costly errors. Hollander, known for his roles in esteemed productions like "Pride & Prejudice" and the "Pirates of the Caribbean" franchise, found himself inadvertently caught in a financial mix-up when his agency mistakenly sent Holland's box office bonus—a substantial seven-figure sum intended for the Spider-Man actor—to Hollander's inbox.

The mix-up at Marvel occurred when Tom Hollander, a British actor renowned for his diverse roles, received an email intended for Tom Holland, the 27-year-old superstar known for portraying Peter Parker/Spider-Man in the Marvel Cinematic Universe. Hollander, with his trademark dry wit, recounted the incident during an appearance on "Late Night With Seth Meyers." He revealed how his agency's accounting department mistakenly directed Holland's box office bonus, a staggering seven-figure sum, to Hollander's inbox.

Read more in Veriety's article

The incident served as a reminder to entertainment industry professionals about the significance of meticulous financial management and accurate record-keeping. While errors may occur, implementing robust systems and protocols, such as Microsoft Business Central, can help mitigate such risks and uphold financial integrity in the industry.

Let's delve deeper into how Microsoft Business Central could have averted this costly blunder and provided the necessary safeguards to prevent such occurrences:

Vendor Management and Data Accuracy:

Microsoft Business Central offers comprehensive vendor management functionalities, ensuring that each vendor's information is accurately recorded. With distinct profiles for every vendor, including details such as name, contact information, and payment terms, Microsoft Business Central minimizes the risk of erroneous payments due to data confusion.

In the context of talent management, Microsoft Business Central could have separate vendor profiles for Tom Hollander and Tom Holland, clearly distinguishing between the two actors. By maintaining accurate records and avoiding ambiguities in vendor identification, the agency's accounts department would have easily identified the correct recipient for Holland's bonus.

Automated Payment Processing:

One of the standout features of Microsoft Business Central is its support for automated payment processing. Microsoft Business Central allows organizations to configure predefined criteria, such as contract terms or project affiliations, to streamline their payment workflows and reduce manual errors.

In the case of bonus payments for actors like Tom Holland, Microsoft Business Central could automate the calculation and disbursement process based on contractual agreements and box office performance metrics. By eliminating manual intervention, Microsoft Business Central ensures accuracy and efficiency in financial transactions, significantly reducing the likelihood of errors such as misdirected payments.

Approval Workflows and Verification Checks:

Implementing approval workflows within Microsoft Business Central adds an additional layer of verification to financial transactions. Authorized personnel can review and approve payments before they are finalized, mitigating the possibility of erroneous transfers. In the context of bonus payments for actors, Microsoft Business Central could establish approval hierarchies based on contractual thresholds and financial limits. For instance, bonuses exceeding a certain amount would require approval from senior management or the legal department. By incorporating verification checks into the payment approval process, Microsoft Business Central enhances accountability and reduces the risk of unauthorized or erroneous payments.

Integration with HR Systems:

Microsoft Business Central's seamless integration with HR systems ensures alignment between employee data and financial transactions. By synchronizing actor contracts, roles, and bonus entitlements, organizations can maintain consistency across departments, minimizing the likelihood of payment errors.

In the case of talent management agencies, Microsoft Business Central could integrate with HR databases to automatically update actor profiles with relevant contract details and payment terms. This integration ensures that finance and HR departments are working with consistent data, reducing the potential for discrepancies or oversights in bonus payments.

The mishap involving Tom Hollander and Tom Holland's bonus payment underscores the importance of robust financial management systems in preventing costly errors.

Microsoft Business Central offers a comprehensive suite of tools, including:

- vendor management,

- automated payment processing,

- approval workflows,

- integration with HR systems.

By leveraging the capabilities of Microsoft Business Central, organizations can enhance accuracy, streamline workflows, and safeguard against financial discrepancies, ensuring smooth operations and preserving professional reputations. With Microsoft Business Central, organizations can navigate the complexities of financial management with confidence, knowing that they have the necessary safeguards in place to prevent costly errors and ensure financial integrity.

More on Microsoft Business Central functionalities:

-

Financial Reporting and Analysis:

Microsoft Business Central provides powerful reporting and analysis tools that allow organizations to gain insights into their financial performance. With customizable dashboards and real-time data, businesses can make informed decisions and identify areas for improvement. In the context of the bonus mix-up, detailed financial reports generated by Microsoft Business Central could have flagged discrepancies in bonus payments, prompting further investigation and preventing the erroneous transfer to Tom Hollander. -

Budgeting and Forecasting:

Effective budgeting and forecasting are essential for managing financial resources and planning for future expenses. Microsoft Business Central offers robust budgeting and forecasting capabilities, allowing organizations to set financial goals, track spending, and anticipate revenue streams. By accurately forecasting box office revenues and bonus payouts, Microsoft Business Central could have alerted the agency to potential errors in bonus allocation, preventing the misdirected payment to Tom Hollander. -

Compliance and Audit Trail:

Compliance with regulatory requirements and internal policies is critical for organizations across industries. Microsoft Business Central helps businesses maintain compliance by providing built-in controls, audit trails, and security features. In the case of bonus payments, Microsoft Business Central's audit trail would have provided a detailed record of the payment approval process, including any deviations from standard procedures. This transparency ensures accountability and facilitates compliance with industry regulations. -

Scalability and Customization:

As businesses grow and evolve, they need financial management solutions that can scale with their needs. Microsoft Business Central is highly scalable and customizable, allowing organizations to adapt the system to their unique requirements. Whether managing a small talent agency or a multinational corporation, Microsoft Business Central provides the flexibility to tailor workflows, reports, and integrations to specific business processes. By leveraging Microsoft Business Central's scalability and customization options, organizations can optimize their financial management processes and prevent errors such as the misdirected bonus payment to Tom Hollander.

In addition to utilizing robust financial management systems like Microsoft Business Central, businesses can further mitigate risks and prevent errors by partnering with experienced solution providers like ElanWave.

ElanWave specializes in providing tailored solutions for financial management, including implementation, customization, and ongoing support for platforms like Microsoft Business Central. With our expertise and industry knowledge, we can help businesses optimize their financial processes, minimize risks, and achieve their goals.

Contact our team today to learn more about how ElanWave can support your organization's financial management needs.