How we built a Loan Origination Platform with Power Platform

When one of the largest banks in South-Central Europe needed to speed up loan processing, we delivered a full origination platform using Microsoft Power Platform and React in just 4 months.

When one of the largest banks in South-Central Europe approached us, they initially envisioned a lightweight tool to simplify loan applications. But as we explored their needs, the scope grew into a full-scale, regionally adaptable platform. Thanks to our agile approach and expertise in Microsoft Power Platform and React, we delivered a complete solution in just 4 months! Without the traditional cost or timeline of custom development.

The solution we delivered showed immediate improvements to the bank's operations.

Loan approval times were significantly reduced, while manual processes became far more accurate. Merchant agents could now complete applications in minutes rather than hours. Loan officers worked more efficiently using tools like risk scoring, income verification, and compliance checks. All accessible in one centralized system. Most importantly, the entire loan pipeline moved faster, allowing the bank to process more applications with the same resources.

This was a technical upgrade, but more importantly, it was a fundamental improvement in the bank’s business processes and how they grew their business.

Here's how we did it.

Choosing the right approach

The existing process of loan origination is a complex workflow. It involves a lot of manual work and approvals, background checks, multiple steps and region-specific documentation.

After initial talks, the client had a vision of utilizing a Power Platform and its capabilities rather than going in the direction of making traditional custom-made software. We fully supported their plan and additionally reassured them with our expertise, years of experience working in the Microsoft ecosystem and our new ideas that could save them time and resources!

We established key principles that would guide our entire development process:

• Cost-effective solution

• Don’t sacrifice quality or flexibility

• Make user-friendly interface to handle loan assessments easily

• Compliance features for different regions

Power Platform in banking done right

As mentioned, the bank needed a solution that could handle complex regional rules while staying agile. Using Power Platform and Power Apps, we built a system that adapted to their unique requirements.

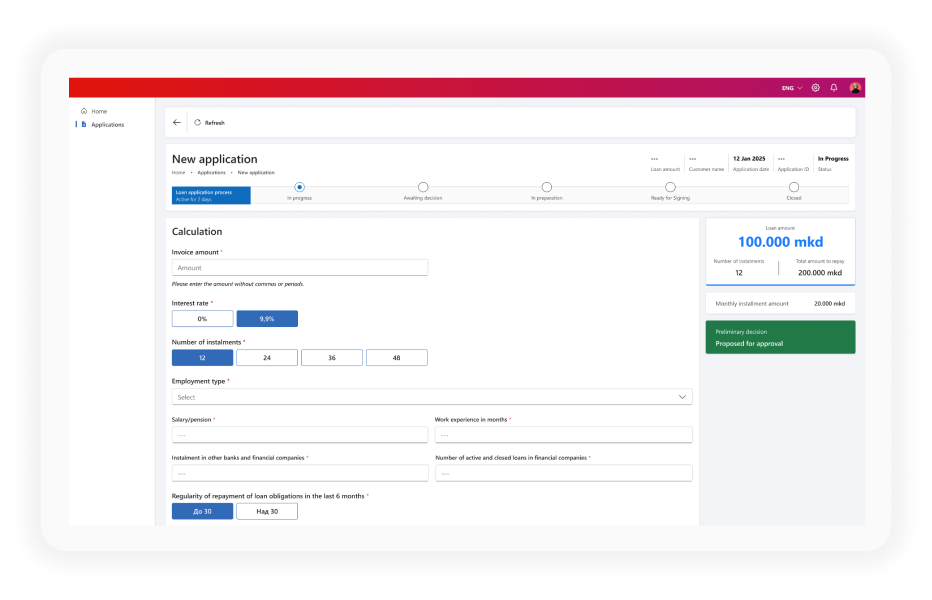

The solution transformed what was once a slow, paper-heavy process into a streamlined digital workflow. By focusing on simplicity, we created a tool that lets:

• Merchant agents submit applications in minutes instead of hours

• Loan officers access all necessary data in one centralized location

• All users work within region-specific rules without added complexity

Most importantly, it removed friction from every step of the loan origination process.

Bringing the solution to life

The solution includes two connected modules:

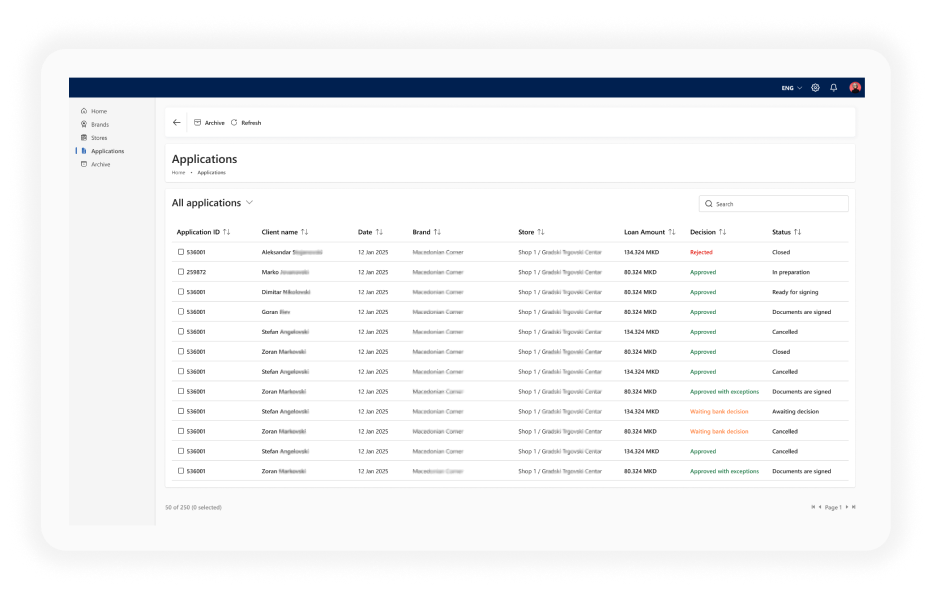

• External – for merchant agents and store managers

• Internal – for the bank’s loan officers and risk teams

This separation ensured usability on the front end and robustness on the back. Both parts are deeply integrated.

The external part of the solution is clean, intuitive and easy to use. Our modern design enabled smooth navigation through each step of the process, meaning that merchant agents would be able to use it right after the initial tutorial session.

The internal part is robust and centralizes all data needed to process loan applications. It is closely integrated with the external segment, allowing the bank to handle requests efficiently from one place.

Features of internal application

Among the many features of the internal solution, two stand out:

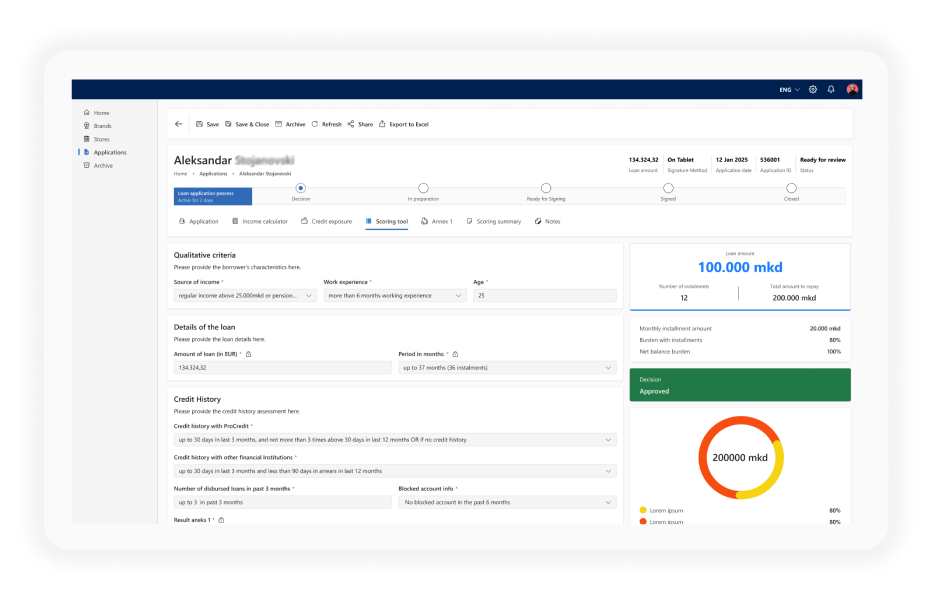

• Scoring tool

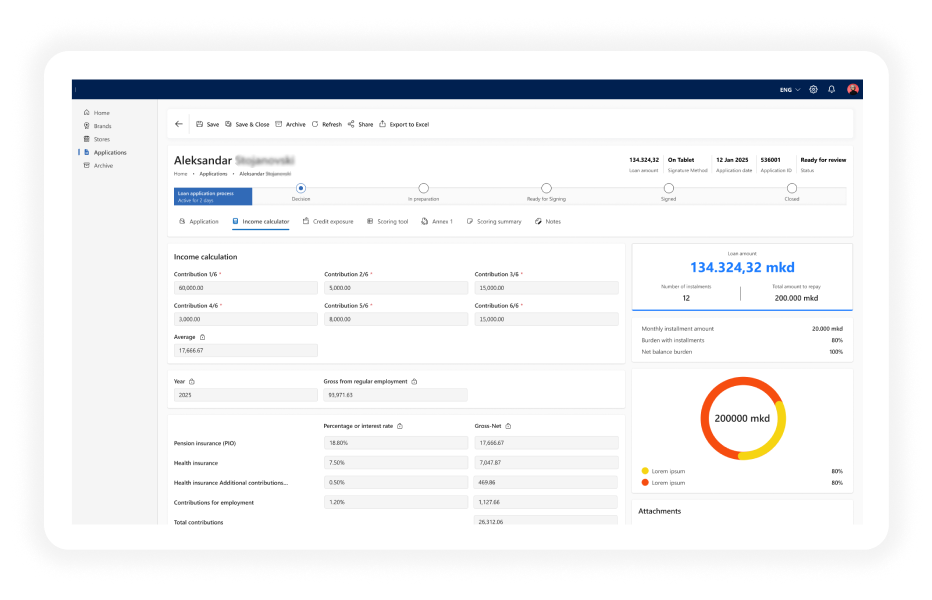

• Income calculator

The scoring tool is an integral part of the solution. It automates the assessment of loan requests based on the client’s existing scoring system.

Income calculator processes data such as pension insurance, health insurance and other contributions combined with salary data and various tax reductions tied to region-specific regulations. It eases the process of assessing the applicant’s loan eligibility. Based on all those factors, the system evaluates if the person is suitable for the loan.

It is important to know that each loan applicant is evaluated individually within the solution we created, based on multiple factors, such as income, credit history, etc. Everything implemented follows quantitative and qualitative assessment criteria provided by the bank’s Risk Department.

Why this solution worked

This project is a great example of how smart tech choices, and the right team can transform and transcend expectations!

What began as a need for a simple loan tool evolved into a complete business solution. That didn’t happen by accident. We always treat our clients’ challenges as our own. We listen closely, we dig deep, and we stay committed, from day one to delivery.

And this is what makes the difference.

Need a loan origination system or digital transformation partner?

We’d love to hear your challenge.